New internal platform in white label solution

ROLE / PRODUCT DESIGNER

ITAÚ UNIBANCO / 2019 - 2020

Overview

Itaú Unibanco, the biggest bank in Latin America with the most valuable brand in Brazil, decided to invest in a white label system to offer a service to any company that wants to have their own credit card, from the customer app to a whole purchase processing system and back office.

MY CONTRIBUTIONS

1. Build the digital strategy with product managers;

2. Plan and design the platform's chassi for the new product;

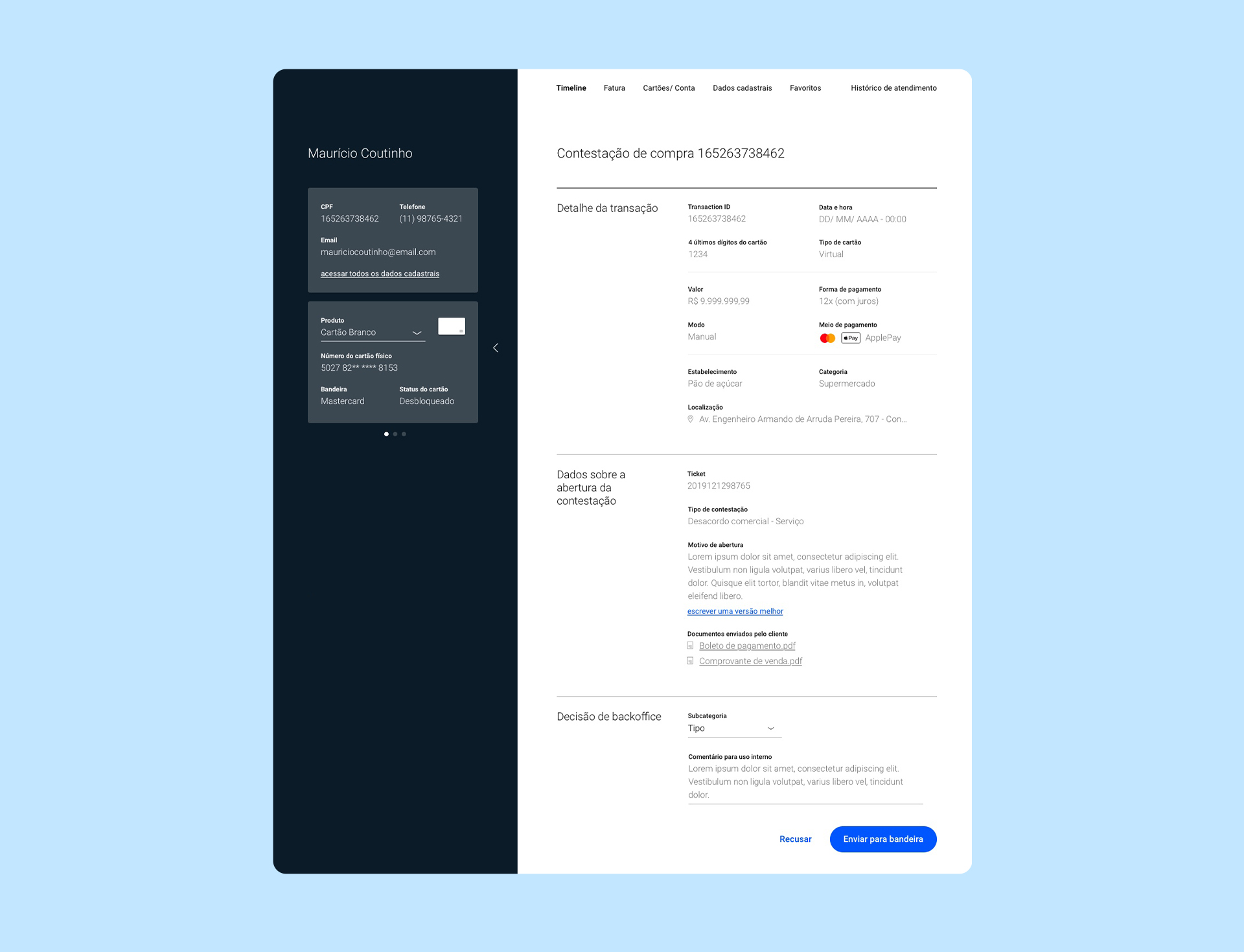

3. Build wireframes and prototypes for critical features (like purchase dispute);

4. Apply user research (shadow, usability and concept tests);

5. Deliver white-label interfaces and components.

01.

Why white-label?

A STARTUP INSIDE OF A BIG COMPANY

I took part in a pilot team with the goal to launch the "future" credit card and we had the endorsement to develop it with the best solutions technologies at that moment.

That's why we decided to build a white-label product because we wanted to be scalable. We started to build the whole credit card system, including the digital platforms for the customer and back office operators.

02.

Cocreating with stakeholders

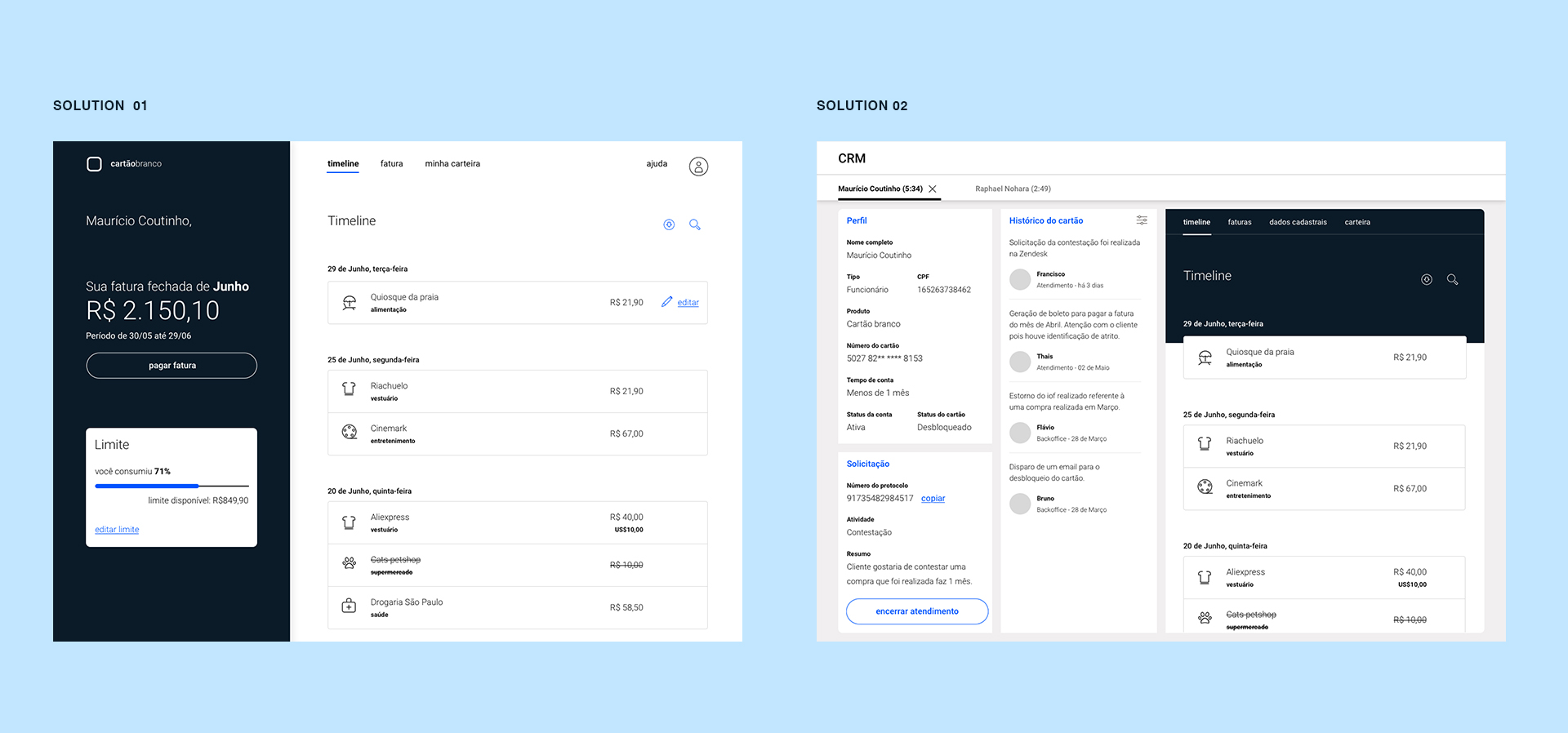

2 WAYS FOR OUR DESKTOP SOLUTION

We wanted to develop a desktop interface structure that could be used for many platforms and users. During the brainstorming, I created 2 experience solutions to discuss with our team the pros and cons of each solution.

Our team was multidisciplinary: design, product, service customer, back-end, and front-end engineers, and risk.

03.

Concept test with users

USER RESEARCH

As a result, we decided to test 2 interface solutions with back office and customer service users. The solutions offered different ways to information consumption, like quantity and how these informations were available.

“We don't have automated tools. To analyze a single purchase, I need to memorize a lot of keyboard shortcuts.”

Back office operator

04.

The same solution for 2 different users

USER RESEARCH INSIGHTS

We built a solution capable to attend 2 users: customers and customer service operators. During the user's research, we realized that both necessities were very similar, because the customer and operator needed to have the same reference and information to make communication easier.

05.

The first Itaú's back office

2 IN 1: A SOLUTION FOR BACK OFFICE AND CUSTOMER

We explored how we could apply the concept of white label and at the same time bring solutions for "the main pains and necessities" of the back office operators and credit card customers.

For the operator, some information needed to be together in the same interface because they wanted to compare data and be agile. Which was very different for customers, who looked for minimalist and simple interfaces. This explained why "time" was very different for both users.

The solution was based on modular interfaces that were able to adapt to any kind of screen dimension, so that's why we segment the experience into vertical sections. This was very important because back office operators used to work with small displays and the customers, with mobiles, or bigger displays. And it was important to us that the website solution had a connection with the app solution, to create an omnichannel experience.

06.

First Itaú's client

FIRST CREDIT CARD

Samsung was the first partner company to have its own credit card with all purchase processing system.

LEARNINGS

I participated in a pilot project when UX Designers started to work as Product Designers. This moment was very important for me because working on end-to-end projects was one of my goals as a designer at that moment.

I learned a lot when I worked on this project not only because of this change but also because we were a team that had the endorsement to test new system solutions and experiences. In a scenario when Itaú Unibanco was the biggest bank in Latin America, we were fortunate.